As automotive electronics becomes more complex, the quest is on for economical ways to cover the widest possible range of requirements.

Eric Pinton | Renesas Electronics

In recent years, few topics have stoked the automotive industry’s collective enthusiasm like autonomous vehicles. Pushed by widely publicized breakthroughs in connected vehicle development, deep learning software, and data-driven analytics by new players such as Google, Tesla, and Uber, auto manufacturers and OEMs have raced to deliver fully autonomous vehicles.

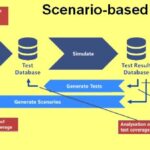

Reality, however, has differed from these ambitions. Many projects have been beset by major delays and foundational challenges. The challenges include the complex architecture demanded by the massive number of heterogeneous sensors in a fully distributed system; the validation of nearly infinite driving use cases; and hardware and software providers having dramatically different business models.

Though autonomous vehicles make business sense to mobility service providers, there are few concrete business cases to justify the investment so far. Additionally, factors such as vehicle electrification and NCAP (New Car Assessment Program, which evaluates new automobile designs for performance against various safety threats) have squelched the hype around autonomous vehicles. Thus OEMs are looking for a more realistic foundation for building sustainable businesses.

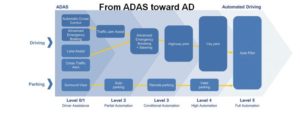

Safety, driven by the next version of NCAP requirements and legislation, remains the primary market driver for ADAS. There are five autonomous functions covered by the NCAP 2020 Assessment – automatic emergency braking, traffic sign recognition, lane-keep assist, vehicle detection, and pedestrian detection. These have became mainstream for vehicles in 2019/2020.

The NCAP assessment is still evolving. Over time, the number of functions it covers has risen. For example, an earlier version of NCAP focused only on front driving. But NCAP 2025 requires 360° surround view, far-distance view, steering, and interior monitoring. Moreover, legislation worldwide is encouraging the use of the cameras for safety purposes. U.S. cars now must have backup cameras. Automatic emergency braking will be mandated in Europe by February 2022, and China has issued new safety legislation for commercial vehicles.

Besides safety, the convenience enabled by certain ADAS (Advanced Driver Assistance Systems) functions–such as automatic parking and adaptive cruise control with steer assist–are likely to boost demand for advanced functions as they become more affordable. For OEMs, this means the most financially viable path to autonomous vehicle development is in adapting their vehicles to the latest NCAP legislation requirements while developing ADAS functions as convenience functions.

A matter of scale

As ADAS becomes more complex, OEMs look for economical ways to cover the widest possible range of requirements. The biggest challenge is in scaling entry level platforms–which cover the minimum ADAS requirements for an NCAP three-star rating–to premium autonomous levels. It’s essential that costs be controlled along the way and every effort be made to reuse elements across the full range of systems.

The trend of integrating several functions into a centralized ECU looks quite appealing when designing for scalability. However, this approach leads to technical challenges for functional safety requirements, power consumption, and revising business models. For example, many OEMs have found that the conventional approach of relying on single-sourced hardware or software no longer works for them. So they develop their own hardware or software in house or divide the work between multiple third parties.

For hardware manufacturers, the challenge is finding a semiconductor vendor able to offer an open platform that can scale devices from entry level to high level while maintaining compatibility for upgrades. And OEMs must master new development methodologies and frameworks if they are to develop their own software or integrate with others. Artificial intelligence (AI) is another challenge, relying on a completely a new class of algorithms still researched a few years ago.

Semiconductor suppliers must adapt their offerings for this new paradigm. Their first challenge is in accommodating functions ranging from entry level to high level while ensuring software will be reusable. Most semiconductor suppliers focus on entry- to mid-level systems where the key competencies are cost, low power consumption, handling critical real-time tasks, and functional safety. These systems represent the high-volume zone for automotive applications.

Semiconductor suppliers from the consumer area face several problems when developing devices for automotive uses: Rigid power consumption needs, functional safety support up to ASIL-D, and high quality requirements with low PPM rates during production. Also challenging is the realization of an efficient bill of material (BOM) when trying to scale down a consumer device.

An open software platform is a must as OEMs integrate software and look for best-in-class software providers. A black-box approach that couples hardware and application software is unsuitable because it locks out software suppliers with leading IP. It is also not ideal for Tier 1 suppliers as it complicates the task of creating value in house. Proprietary software also hinders the task of porting algorithms into an optimized hardware platform. The problems involved explain why many OEMs prefer open standards such as those from Khronos Group, which are supported by multiple third parties and suppliers.

AI, meanwhile, is widely used for data center applications. The challenge here is embedding AI while accounting for constraints governing automotive systems: low power, functional safety and low cost, while optimizing the power/performance ratio. Consequently, OEMs have a long road to travel for ADAS/AD.

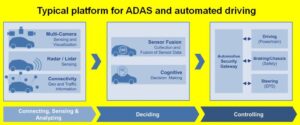

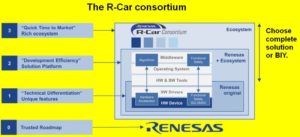

To address the demands for flexible, scalable, and open environments, Renesas developed the Renesas autonomy platform for ADAS and automated driving. This platform leverages the RH850 MCU for real-time and functional safety and R-Car System on Chip (SoC) for high computing performance. The Renesas autonomy platform addresses the needs of OEMs and Tier 1 suppliers with: An open architecture that gives developers the freedom to buy or develop in house; embedded innovation, cutting edge IP, and AI with required IS026262 certifications; and support from a global supplier with decades of experience supplying high-quality products at high volume, paired with a committed road-map.

The first products from this new platform – the R-Car V3M and R-Car V3H SoCs – are now in full mass production, deployed worldwide for front camera, surround view, and lidar applications. The entry-level R-Car V3M covers the NCAP2020 “5 Star” market and upcoming legislation requirements. It also provides an economical solution for 3D surround view systems. The R-Car V3H is optimized for premium smart camera features and is also suitable for convenience functions such as automatic parking and lidar systems.

Both R-Car devices can accommodate embedded conventional computer vision algorithms and AI for embedded systems. Renesas continues to work toward future market requirements in next-generation devices such as NCAP2025 and autonomous functions for Level 2+/Level 3 ADAS platforms.

Leave a Reply