A two-part tutorial series on Low-Power Wide Area Network (LPWAN) technology & implementation.

Low-power wide-area networks have continued gaining momentum over the last few years, propelled by IoT growth and sensor ubiquity. In this article, we will answer the basic, frequently asked questions, and offer insights on the implementation strategy.

There are different abbreviations for the technology. The most commonly used are LPWAN or LPWA. Once in a while, you will see LPN used. But they all refer to the same technology. We will use LPWAN throughout the article.

1. What is an LPWAN?

An LPWAN is a wireless telecommunication network enabling the long-range transfer of data at very low power. The data rate supported ranges from 0.3 kbits/s to 1 Mbits/s per single channel. It is also relatively low cost. LPWAN use prevails among the large number of battery-operated IoT sensors installed in remote locations for various types of applications.

2. How many types of LPWAN are available today?

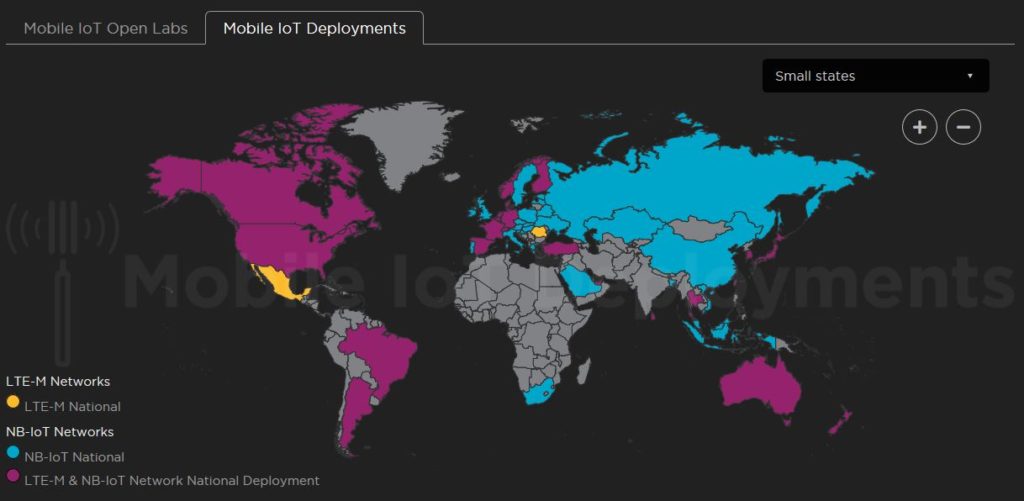

Many types of LPWAN are available today. The most prevalent LPWANs include long range wide-area network (LoRaWAN), Long Term Evolution for Machines (LTE-M), and Narrowband-IoT (NB-IoT). The LTE-based solutions (LTE-M/NB-IoT) are supported by all the major carriers, including AT&T, Verizon, and T-Mobile. Additionally, according to AT&T, the future development of LTE-M and NB-IoT will be included in 5G globally. Other LPWANs, such as Weightless, SigFox, Wi-SUN, and Ingenu tend to focus on different niches.

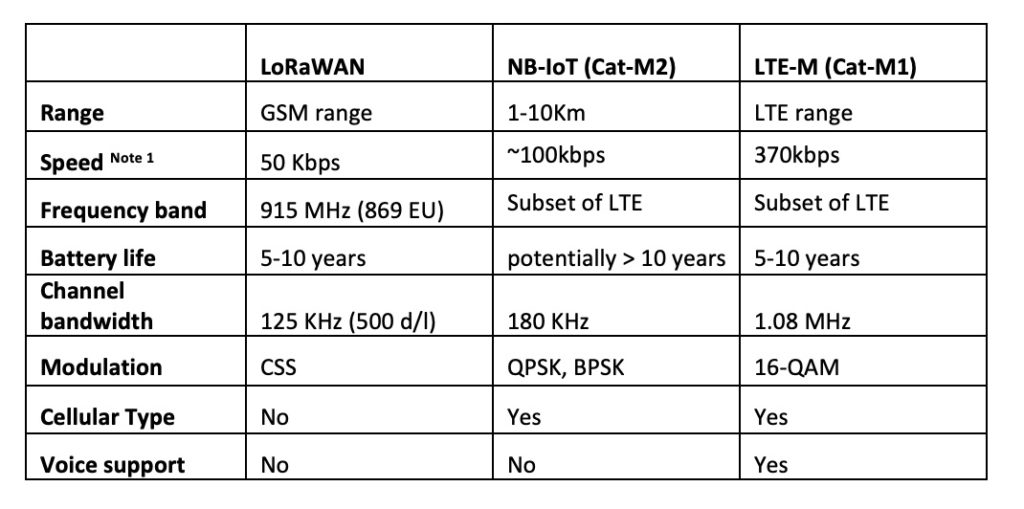

LoRaWAN uses an unlicensed spectrum and uses do not need to pay a license fee. It is primarily used in a smaller geographic region. Both LTE-M (also known as LTE Cat M1) and NB-IoT (also known as LTE Cat M2) are cellular-based much like our mobile phones, and users pay the carrier for the services.

Note 1: The LTE-M/NB-IoT speed shown here is available today from LTE carrier(s). The theoretical speed of LTE-M is 1 Mbps.

3. What is the difference between LTE-M and NB-IoT?

While both LTE-M and NB-IoT are cellular-based, LTE-M supports a higher data rate (1 Mbps) and has voice support capability, VoLTE. In applications such as asset tracking crossing multiple states which require greater bandwidth and/or voice over LTE, LTE-M will be more applicable.

On the other hand, NB-IoT, using a single narrow band, has a higher density of energy for transmission. Therefore it has better building penetration and reach than LTE-M. It is more suitable for smart meter and sensor deployments where small packets of data are sent infrequently, commonly referred to as machine-to-machine (M2M) applications.

4. What are some of the applications of LPWAN?

LPWAN are used in many different areas for tracking and monitoring, including the following:

- agriculture

- asset tracking

- energy management

- healthcare

- industrial IoT

- industrial automation

- livestock farming

- power grid

- smart building

- smart cities

- smart lighting

- smart manufacturing

- smart metering and parking

5. Who are the market leaders today?

LoRaWAN and LTE-based LTE-M/NB-IoT remain the market leaders for low-power deployed sensors.

The LoRa Alliance, (the alliance organization behind the LoRaWAN technology) has a vast reach in its 400+ members, including IBM, Microchip, Cisco, Semtech, Bouygues Telecom, Singtel, KPN, Swisscom, Fastnet, and Belgacom. Its ability to operate on multiple region-specific frequencies extends LoRaWAN’s reach.

On the other hand, LTE-M/NB-IoT’s commercial reach comes from leveraging the existing LTE infrastructure, which is supported by LTE’s high data rate applications, i.e., cell phones, thereby enabling low upfront deployment costs.

According to 360 Research Reports, a technology market research firm, the worldwide LPWAN market is expected to grow from less than $1 billion in 2019 to more than $14 billion by 2026 with a compound annual growth rate (CAGR) of 46.5%. See link below. (Compare with other projections, 360 Research Reports’ forecast seems to be the most reasonable). Additionally, the estimate of the market split is 54% LTE, 36% LoRaWAN, and 10% for the others according to Tech Idea Research.

In the race between LoRaWAN and LTE-M/NB-IoT for market share, the LoRa Alliance aims to foster an ecosystem with increased collaboration that can operate as private or public networks. At the same time, LTE-M/NB-IoT seeks to gain an advantage by riding on the shoulders of LTE.

LPWANs such as Weightless, Sigfox, Wi-SUN, and Ingenu are niche players. For example, Weightless focus on smart meters. Sigfox is fairly established in Europe but much less so in other regions. Ingenu is focused on sectors such as utilities and oil and gas exploration, while Wi-SUN is specifically for power grid applications.

Part 2 continues here.

Leave a Reply