by Kevin Tang, Sr. Director, Strategic Business Development, ON Semiconductor

Market demand for higher bandwidth broadband services is on the rise, thanks to the rapid growth of the internet, social media, and online streaming services, especially as the number of broadband users per household increases and the trend of cord-cutting continues to accelerate. Across urban, suburban, and even rural areas, OTT (over-the-top) video, cloud gaming, and VR/AR services will continue to proliferate with higher resolution content to meet consumer demand. According to the latest Cisco VNI Forecast[1], total Internet video traffic is expected to grow to 82% of all Internet traffic in 2022, up from 67% in 2016. Yet only 44% of broadband connections globally are above 50Mbps. According to the recent FCC Internet Access Services report [2], 33.5 million households in the US still have a fixed-line connection below 25Mbps downlink speed, mostly handicapped by aging copper infrastructure.

Fixed broadband networks using copper, cable, or fiber have generally been the preferred choices for delivering broadband services. The cost and complexity of upgrading or extending the fixed-line footprint has continually challenged the roll-out, as monetization typically exceeds 10 years. Fixed wireless access (FWA) leverages wireless medium to provide last-mile broadband connections with access points (AP) installed on building rooftops or existing street furniture and has the fundamental advantage of time to market and lower deployment complexity and cost. To meet ever-growing consumer demand for higher bandwidth across regions, FWA has become a very attractive option for operators to extend their broadband networks with value-added services.

FWA business case for operators

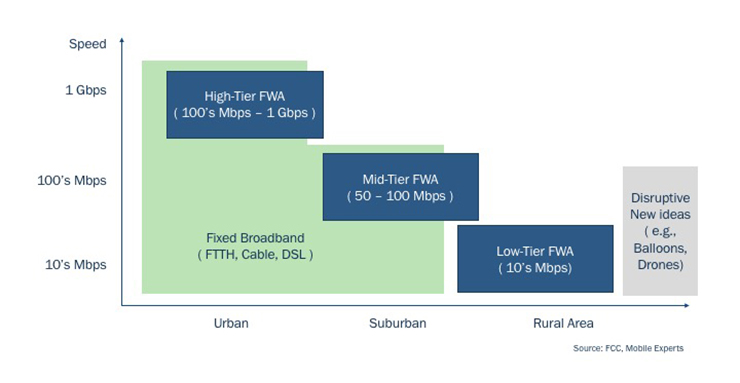

While FWA has traditionally focused on unserved or underserved rural areas where the economics of fixed-line deployment didn’t make sense, the advancement of FWA technology, network equipment, and availability of spectrum (unlicensed, Citizens Broadband Radio Service and mmWave bands) open up market opportunities in urban and suburban areas as well, positioning FWA as a favorable alternative to traditional fixed-line options with FTTH (fiber to the home), cable, or DSL (digital subscriber line), providing fiber-equivalent speeds and lower prices across regions.

The competitive advantage of FWA is that it allows operators to create new business opportunities and drive new revenues based on the operator’s business profile. A mobile operator can expand its competitive offering with a fixed broadband play that complements existing mobile service. A fixed-line broadband operator can deploy FWA as a complement to fiber in dense urban areas where there is no timely and cost-effective way to deploy fiber or upgrade DSL.

In addition to faster deployment and lower cost, with the availability of unlicensed and mmWave bands, FWA also allows operators to scale to address both dense urban and rural areas. The business case for FWA is particularly attractive in dense urban markets where there’s only one or none high-speed broadband provider, and/or where FTTH is under-built, such as some parts of US and Western Europe. Some ambitious startups and wireless ISPs like Starry also plan to compete with major operators using fixed wireless technology. Internet companies like Google and Facebook have also invested in developing their own fixed wireless technologies and networks.

FWA technology based on Wi-Fi

In the past, cellular technologies like WiMax and 4G LTE have played a major role in the FWA network with only limited commercial success. Some of the issues being high CPE (customer- premises equipment) cost and insufficient network capacity to deliver expected service. As there are no official standards for fixed wireless access, operators adopt proprietary vendor solutions incorporating different spectrum and interference mitigation technology to achieve capacity goals and lower cost per bit.

While 5G technology promises greater capacity and technical advancements compared to 4G, mobile operators looking to leverage 5G infrastructure for FWA play will be taking a more cautious approach given the potential impact of additional traffic load created by FWA. Excess mobile capacity will vary depending on regions and how mobile applications evolve over time.

Wi-Fi-based solutions have also been widely used for FWA leveraging mass market chipsets. With the new capabilities of 802.11ax, as known as Wi-Fi 6, has a number of enhancements and has been increasingly adopted to deliver fiber-like speed as well as to provide significant improvements in network efficiency and capacity, while leveraging economy of scale of massive Wi-Fi ecosystem and supply chain. This has led to achieving fiber-equivalent capacity and capabilities of delivering 100 Mbps to 1 Gbps+ speeds per user as well as lower CPE cost, making the technology scalable for address dense urban markets and rural areas using mmWave bands and/or unlicensed bands.

Some of the key Wi-Fi 6 enhancements are highlighted below:

- Capacity boost with 8×8 MIMO and 160MHz

The ability to support 8 simultaneous data streams over 160 MHz channel bandwidth from a single AP has significantly boosted per-sector capacity versus the previous generation of devices with lower-order MIMO configurations. With 1024-QAM, each data stream is now capable of carrying over 1 Gbps of data traffic. Combining 8×8 MIMO and 1024-QAM drives up the overall capacity of a single AP to close to 10 Gbps, approaching FTTP capability. This means a single FWA sector with 8×8 MIMO and 1024-QAM can now support 200 Mbps per user based on the over-subscription factor of 50:1.

- Multi-User MIMO (MU-MIMO)

MU-MIMO technology in Wi-Fi aims at increasing overall network capacity by simultaneously beam steering to different users, effectively offering higher speed on a per-user basis. In addition, coordinated scheduling for both down-link and up-link data traffic provide a more efficient allocation of airtime to overcome previous performance bottlenecks and inefficiencies with contention-based wireless access. This enables FWA to serve a large number of CPEs and drive down deployment cost at scale.

- Unlicensed Spectrum Extended

With 6 GHz spectrum opening up for unlicensed use, first in the US, followed by EU and other regions, up to 1.2GHz will be available for unlicensed use. This is a significant inflection point for the broader Wi-Fi industry as applications based on higher Wi-Fi connectivity speeds continue to grow. FWA equipment makers will now be able to leverage the same chipsets at mass scale for 6GHz unlicensed deployment as early as next year.

Looking ahead to universal high-speed broadband access

As market demand for universal and higher-speed broadband access, FWA will play a major role in enabling that vision. Wi-Fi-based FWA is uniquely positioned to provide high capacity and high-efficiency network that can be deployed at mass scale. Next-generation Wi-Fi with 802.11be is looking to build on 802.11ax to deliver 30 Gbps or higher bandwidth. Riding on the back of Wi-Fi technology advancement and market scale, the FWA network will deliver significant performance and cost advantage as well as time to market as operators look for viable options to either challenge or complement existing fixed-line infrastructure.

About the author

Kevin is a part of marketing team for Quantenna Connectivity Solutions at ON Semiconductor. He leads business development initiatives across multiple markets as well as new wireless connectivity portfolio and roadmap. Prior to ON semiconductor, Kevin led strategic planning and product marketing at Corigine in Telco and Cloud Data Center space. He spent 17 years at Marvell and Qualcomm, managing wireless connectivity portfolios (Wi-Fi, Bluetooth, GPS, NFC, and Zigbee), leading worldwide Product Marketing and Business Development across Mobile, Consumer, Automotive, and Enterprise markets. Kevin specialized in Systems Design at the start of his career and was part of the founding Wi-Fi team at Marvell. Kevin holds an MBA from UC Berkeley Haas, an MSEE from Stanford, and a BSEE from University of Illinois at Urbana-Champaign.

Kevin is a part of marketing team for Quantenna Connectivity Solutions at ON Semiconductor. He leads business development initiatives across multiple markets as well as new wireless connectivity portfolio and roadmap. Prior to ON semiconductor, Kevin led strategic planning and product marketing at Corigine in Telco and Cloud Data Center space. He spent 17 years at Marvell and Qualcomm, managing wireless connectivity portfolios (Wi-Fi, Bluetooth, GPS, NFC, and Zigbee), leading worldwide Product Marketing and Business Development across Mobile, Consumer, Automotive, and Enterprise markets. Kevin specialized in Systems Design at the start of his career and was part of the founding Wi-Fi team at Marvell. Kevin holds an MBA from UC Berkeley Haas, an MSEE from Stanford, and a BSEE from University of Illinois at Urbana-Champaign.

[1] Cisco Visual Network Index (VNI) Complete Forecast Update 2017-2022:https://www.cisco.com/c/dam/m/en_us/network-intelligence/service-provider/digital-transformation/knowledge-network-webinars/pdfs/1213-business-services-ckn.pdf

[2] Internet Access Services: Status as of December 31, 2017 by FCC: https://docs.fcc.gov/public/attachments/DOC-359342A1.pdf

Leave a Reply